I’ve been having trouble blogging lately. Part of it has been that I’ve spent the last two years heads-down, building a business. But now that I’m looking around, I don’t see much happening in EdTech. Anywhere. I can write about big trends that will affect education. Plenty is happening in that arena. But at least at first glance, the EdTech sector looks frozen. I’m not talking about frozen as in the normal much-activity-but-little-progress way. I mean that, other than integrating ChatGPT into everything in shallow and trivial ways, I don’t see anybody doing much of anything.

I’m probably seeing an oversimplified picture. First, I have bigger blind spots than usual at the moment. Second, there’s so much happening in the macro-environment that some EdTech companies are probably working on larger plans behind the scenes. With changes like major demographic student switches, huge swathes of the economy being reconfigured, and profoundly impactful technologies popping up seemingly out of nowhere, companies need time to plan and implement appropriately significant responses.

But I also sense a lot of paralysis. Some may be confused about various large shifts and be confused about how to make sense of whatever sparse data they can get their hands on. (I certainly am.) They may not know what to do yet. And since we’re in a financial environment in which very few companies have a lot of money to spend, some EdTech firms may simply be unable to execute any strategy other than treading water at the moment.

Then again, some companies—even some industries—may not have effective responses to the changes. They may disappear.

I fed Bob Dylan’s famous line “He not busy born is busy dying” into OpenAI’s DALL-E 2 image generator, having very little idea of what the software would do with that prompt. Surprisingly, its output perfectly sums up my current thinking about the EdTech situation:

Clarity. It would be nice to have, wouldn’t it? Sadly, even in this age of magical AI genies, you can’t always get what you want.

But if you try sometimes, you get what you need. All I have is a bunch of older observations as a baseline, a few facts, a few conjectures, and a lot of questions. Still, that’s a place to start.

Shall we try?

A little context

Look, everything is a mess right now. Everybody knows it. Still, it’s worth taking a beat to remind ourselves that the landscape is at least as confusing for vendors as it is for universities.

First, there’s enrollment. We know that the United States is approaching the bottom of a long demographic dip in traditional college-aged students. We know it isn’t hitting every geographic area at the same time or with the same intensity. We know that the post-COVID labor market changes, the messed up supply chain that is still reconfiguring itself thanks to geopolitical changes, the tight labor market, the unwinding of a decade of high-stimulus monetary policy, and the high cost of college have all conspired to make enrollment changes odd, unpredictable, and unsettling. We have a handful of data points and endless surveys of student and work attitudes. And then there’s the looming potential recession. Nobody knows what will happen next year or the year after. Nobody knows what’s fleeting, somewhat long-term, or permanent.

If you’re building or running an EdTech company, how do you prepare for this? The most obvious strategy is to slash expenses and wait until the environment becomes clearer. That has worked in the past because, frankly, the education markets haven’t changed much or quickly. Downturns have been cyclical. This time may be different. In fact, it probably will be. But it’s hard to know how it will be different or how quickly it will change.

As universities realize that traditional enrollments may be harder to reach, I’m hearing a lot more talk about competency-based education (CBE), micro-credentials, and aligning education with skills, and work. Talk from universities. And a small number of industries, some of which (like allied healthcare) have been doing stackable micro-credentials for decades before that term was invented. Will the continuous education approach be taken up more broadly by a wider range of industries? Again, we have lots of surveys. I’ve not looked closely at the latest data. But nothing I’ve come across has convinced me that we actually know. What do you do about this if you’re an EdTech company? Pivots to corporate learning and development haven’t produced many great successes (although they have enabled some start-ups that would have folded to scrape along). There’s…something here. But what? How much do you bet on CBE taking off? And where do you place your chips?

We also know that generative AI is a big deal. How do we know? Mainly because ChatGPT and its growing list of competitors continue to surprise us. Whenever something we’ve built surprises us with regularity, that means we don’t understand its implications yet. Anyone who says they know what’s going to happen next is either reading too much science fiction, a billionaire who is used to saying made-up stuff without consequence, or both. So far in my world, most of the new “AI-powered” applications I’ve seen are hasty and trivial integrations with ChatGPT. They are so easy to reproduce that they are more likely to be feature sets than products.

That will change. But it will take a while. The underlying AI stack is evolving rapidly and could take multiple paths. Meanwhile, most folks are very early in their process of thinking about what the tools are and aren’t good for. Some industries have been thinking about, working with, and investing in AI in a serious way for some time. Education isn’t one of them. We’ve been caught flat-footed.

And unfortunately, most EdTech companies don’t have money to invest now even if they knew what to invest in. That’s true of startups, publicly traded companies, and private equity-held companies.

The start-up picture is brutal. Take a look at this investment trend:

Believe it or not, the chart understates just how bad the situation is. Last year, nearly half of all EdTech funding went to one company—BYJU’S—which is now struggling to make its debt payments. Three-fourths of all EdTech VC financing in 2022 went to just five start-ups. Given that the total pot shrank by 50% to begin with, there was nothing at all for most start-ups. This year isn’t exactly looking great either.

Nor are publicly traded EdTech companies faring better. Take a look at 2U’s stock price trend over the past five years:

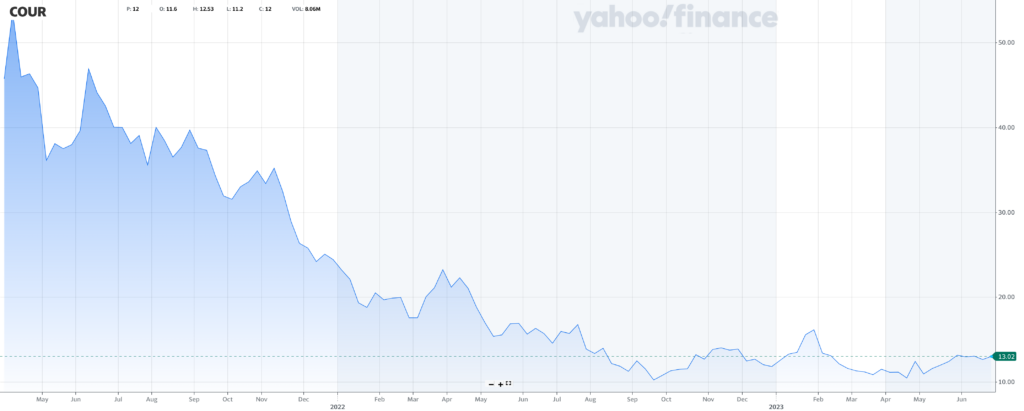

Coursera doesn’t look so great either:

It’s weird to say, but this is one time that 2U and Coursera might prefer to be Pearson:

Then again, if we zoom out to look at a 10-year time horizon rather than 5 years, Pearson’s picture looks different:

Coursera, 2U, BYJU’S, and all the other EdTech unicorns should be worried that maybe they are Pearson. That their previous valuations were created by conditions that have come and gone, never to be seen again. Interest rates have stayed pinned at historic lows for the last fifteen years, ever since the Fed injected liquidity into the market to save the banking sector. The resulting cheap money was like rocket fuel for these companies and for the investors who funded them. It’s been easy, relative to historical norms, for somebody with money to seem like a genius by making more money. Meanwhile, EdTech business models are being tested in these turbulent times. Who will endure? Who will adapt? Who will catch a new wind in their sails? I don’t know.

In the coming months and years, we’re going to find out who the real geniuses are. Interest rates are not going back to where they were. Loan covenants will be more expensive, valuations will be harder to earn, and VCs will have a harder time raising money for their funds. And all this hits at a moment of great uncertainty and change in the sector.

It’s not surprising that EdTech is quiet at the moment. We’re in a pregnant pause as companies face the new realities confronting them and decide what to do. The question is, which of them are busy being born, and which are busy dying?

I’ll read the tea leaves. But as I wrote earlier, I have more questions than answers.

Textbook publishers

Yes, in 2023, the providers of digital curricular materials and interactive learning experiences are still widely called “textbook publishers.” It’s not for lack of trying to rebrand. For a while, McGraw-Hill Education was calling itself a “learning science company” and Pearson was calling itself a “learning company”. Maybe they still are.

The cynical jokes are much too easy here. Both companies made real efforts to transform themselves. For example, I wrote a post in 2013 about how Pearson was trying its rebuild the entire company, from HR policies upward, into one that was singularly focused on products that provided measurable improvements in student learning, or “efficacy”:

Love ’em or hate ’em, it’s hard to dispute that Pearson has an outsized impact on education in America. This huge company—they have a stock market valuation of $18 billion—touches all levels from kindergarten through career education, providing textbooks, homework platforms, high-stakes testing, and even helping to design entire online degree programs. So when they announce a major change in their corporate strategy, it is consequential.

That is one reason why I think that most everybody who is motivated to read this blog on a regular basis will also find it worthwhile to read Pearson’s startling publication, “The Incomplete Guide to Delivering Learning Outcomes” and, more generally, peruse their new efficacy web site. One of our goals for e-Literate is to explain what the industry is doing, why, and what it might mean for education. Finding the answers to these questions is often an exercise in reading the tea leaves, as Phil ably demonstrated in his recent posts on the Udacity/SJSU pilot and the layoffs at Desire2Learn. But this time is different. In all my years of covering the ed tech industry, I have never seen a company be so explicit and detailed about their strategy as Pearson is being now with their efficacy publications. Yes, there is plenty of marketing speak here. But there is also quite a bit about what they are actually doing as a company internally—details about pilots and quality reviews and hiring processes and M&A criteria. These are the gears that make a company go. The changes that Pearson is making in these areas are the best clues we can possibly have as to what the company really means when they say that they want efficacy to be at the core of their business going forward. And they have published this information for all the world to see.

These now-public details suggest a hugely ambitious change effort within the company.[…] I can say with absolute conviction that what Pearson has announced is no half-hearted attempt or PR window dressing, and I can say with equal conviction that what they are attempting will be enormously difficult to pull off. They are not screwing around. Whatever happens going forward, Pearson is likely to be a business school case study for the ages.

Can Pearson Solve the Rubric’s Cube?

Pearson put out an announcement that looked like fluff, ultimately producing results that looked like fluff that blew away in the wind, but nevertheless tried very hard to change itself. For years.

The problem, as I noted back then, is that textbook companies like Pearson are neither positioned with their customers nor internally equipped to think about improving student success in a way that would be helpful:

Of course, Pearson[‘s] decision to pursue this strategy as what has historically been a textbook company also raises some different questions. As you think about Pearson declaring that they are now focused on evaluating all their products based on efficacy, one reaction that you may be having is something along the lines of, “Wait. You mean to tell me that, for all of those educational products you’ve been selling for all these years, your product teams are only now thinking about efficacy for the first time?” Another reaction might be, “Wait. You mean to tell me that you think that you, a textbook company, should be defining the learning outcomes and determining the effectiveness of a course rather than the faculty who teach the course?”[…]

It’s impossible to unpack the meaning of Pearson’s move without putting it in the context of the historical relationship between the textbook industry and the teachers who adopt their products. Despite all of the complaints about how bad textbooks are and how clueless these companies are, the relationship between textbook publishers and faculty is unusually intimate. To begin with, I can’t think of any other kind of company that hires literally thousands of sales representatives whose job it is to go visit individual faculty, show them the company’s products, answer questions, and bring feedback on the products back to the company. And speaking of those products, the overwhelming majority of them are written by faculty—many with input from an advisory committee of faculty and pre-publication reviews by other faculty. You can fairly accuse the textbook publishers of many different faults and sins, but not taking faculty input seriously isn’t one of them. Historically, they have relied heavily on that faculty input to shape the pedagogical features on the textbooks. And they have had to, because most of the editors are not teachers themselves. More often than not, they started off as textbook sales reps. If they taught at all, it was typically ten or twenty years ago, and just for a few a few years—long enough for them to figure out that teaching and the academic life weren’t for them. This doesn’t mean that they don’t care about pedagogy or don’t know anything about it, but it does mean that most of what they know comes from talking with their authors and customers.

And by “customers,” I mean faculty, despite the fact that it is the students who actually buy the product. Pearson’s choice to build their learning outcomes effort around a term that comes from the pharmaceutical industry is an historically apt one for the textbook industry. In higher education in the United States, faculty prescribe textbooks and students purchase them. As a result, textbook publishers have generally designed their products to please faculty rather than students. One consequence of this is that they had no need to distinguish product features that offer faculty convenience from those that actually impact student learning. When faculty/customers said to the textbook publishers, “I want my book to come with slides, lecture notes, and a self-grading homework platform so that I don’t have to put as much work into that annoying survey course the department head is making me teach,” then that’s what they provided. Whether that collection of materials had positive impact, negative impact, or no impact on student outcomes was not a question that the textbook publisher had any particular reason to ask. For the most part, the publishers relied on their authors and customers to make good decisions for the students. As long as the they provided the raw materials that the faculty said they needed, the companies’ work was done.

Can Pearson Solve the Rubric’s Cube?

Nothing in Pearson’s history prepared it to think about how effective its products are at helping students learn. That wasn’t what its customers had looked to it for. They had little data and little historic expertise from which to start their transformation. By and large, their digital products were not designed to provide data necessary to improve student learning, never mind.

Worse, they really didn’t know how to work with their customers on their new mission. Academic institutions were not about to cede their responsibility for student success to textbook publishers. It would have to be some kind of partnership. But Pearson and their peers had no idea what that partnership should look like.

Internally, changing the way they think about answering the questions that the framework asks them will entail as much subtle, difficult, and pervasive re-engineering of the corporate reflexes and business processes as the work being undertaken now. As I described earlier, all textbook companies that have been around for a while are wired for a particular relationship with faculty that is at the heart of how they design, produce, and sell their products. Their editors have gone through decades of tuning the way they think and work to this process, and so have their customers. When Pearson layers a discussion of efficacy onto these business processes, a tension is created between the old and new ways of doing things. Suddenly, authors and customers don’t necessarily get what they want from their products just because they asked for them. There are potentially conflicting criteria. The framework itself provides nothing to help resolve this tension. At best, it potentially scaffolds a norming conversation. But a product management methodology that can combine knowledge about efficacy, user desires, and usability requires more tools than that. And that problem is even worse in some ways now that product teams have multiple specialized roles. The editor, author, adopting teacher, instructional designer, cognitive science researcher, psychometrician, data scientist, and UX engineer may all work together to develop a unified vision for a product, but more often than not they are like the blind man and the elephant. Agreeing in principle on what attributes an effective product might have is not at all the same as being able to design a product to be effective, where “effective” is shared notion between the company and the customers.

Pearson will need to create a new methodology and weave it into the fabric of the company. There are a number of sources from which they can draw. The Incomplete Guide mentions Lean Startup techniques, which are as good a place to start as any. But there is no methodology I know of that will work off-the-rack for education, and there certainly is no talent pool that has been trained in any such methodology. I have worked with multiple educational technology product teams in multiple companies on just this problem, and it is very, very hard. In fact, it may be the single hardest problem that the educational technology industry faces today, as well as one of the harder problems that the larger educational community faces.

Can Pearson Solve the Rubric’s Cube?

They never did solve this problem.

In retrospect, the fatal flaw in the industry may be its very raison d’être. In the analog world, textbook publishers enabled faculty to outsource portions of their course designs to other faculty who, as authors, were aided in design, production, sales, and distribution by the companies. Because the products were just pages in a book, their adopters could pick and choose what they used and how they used it. But they also had to pick and choose. And adapt. And fill in gaps. That process, the work of turning raw curricular materials into a finished, tailored curricular experience, is increasingly where the value is. It was in 2013 and it certainly is now. But nobody turns to textbook publishers to help with that job.

I wrestled with this same problem when I was an employee at Cengage, just a couple of years before I wrote the Pearson post. MindTap was the first learning platform from a major publisher to shift the paradigm from a learning experience modeled after a classroom—the LMS—to one that centered on the substance of the course itself. It started with a loose book metaphor—think “scope and sequence”—but was very flexible and configurable. Beyond our plan to support all the LTI tools that plug into an LMS, we had a very flexible MindApps API that enabled a richer integration. For example, we integrated several different note-taking apps. Students using, say, Evernote, could take their notes in the margin of a MindTap title. The content would be synchronized with Evernote. And it would stay in the students’ note-taking app forever. MindTap was intended to be the hub, but not the walled garden, of a new, more expansive digital learning ecosystem. One that was centered on tailored, student-centered learning design rather than on publisher content.

Customers liked MindTap a lot. Some of them liked Cengage’s textbook franchises less. They wanted to license the platform and put their own content in it. Despite the urging of some of us both inside and outside the company, Cengage refused. The company was focused on the value of its content.

Since I wrote my Pearson efficacy post, which was the same year that the firm’s stock price peaked in that 10-year graph above, publishers have lost 35% of their revenues. They have been bought by private equity firms, filed for bankruptcy, tried and failed to merge, bought OPM companies only to put them up for sale, and tried many other tactics. Nothing has worked.

That situation just got worse with generative AI. As I wrote recently,

Generative AI is a commoditizing force. It is a tsunami of creative destruction.

Consider the textbook industry. As long-time e-Literate readers know, I’ve been thinking a lot about how its story will end. Because of its unusual economic moats, it is one of the last media product categories to be decimated or disrupted by the internet. But those moats have been drained one by one. Its army of sales reps physically knocking on campus doors? Gone. The value of those expensive print production and distribution capabilities? Gone. Brand reputation? Long gone.

Just a few days ago, Cengage announced a $500 million cash infusion from its private equity owner[….]

What will happen to this tottering industry when professors, perhaps with the help of on-campus learning designers, can use an LLM to spit out their own textbooks tuned to the way they teach? What will happen when the big online universities decide they want to produce their own content that’s aligned with their competencies and is tied to assessments that they can track and tune themselves?

Don’t be fooled by the LLM hallucination fear. The technology doesn’t need to (and shouldn’t) produce a perfect, finished draft with zero human supervision. It just needs to lower the work required from expert humans enough that producing a finished, student-safe curricular product will be worth the effort.

How hard would it be for LLM-powered individual authors to replace the textbook industry? A recent contest challenged AI researchers to develop systems that match human judgment in scoring free text short-answer questions. “The winners were identified based on the accuracy of automated scores compared to human agreement and lack of bias observed in their predictions.” Six entrants met the challenge. All six were built on LLMs.

This is a harder test than generating anything in a typical textbook or courseware product today.

The textbook industry has received ongoing investment from private equity because of its slow rate of decay. Publishers threw off enough cash that the slum lords who owned them could milk their thirty-year-old platforms, twenty-year-old textbook franchises, and $75 PDFs for cash. As the Cengage announcement shows, that model is already starting to break down.

How long will it take before generative AI causes what’s left of this industry to visibly and rapidly disintegrate? I predict 24 months at most.

ChatGPT: Post-ASU/GSV Reflections on Generative AI

This week I saw a quick, offhand demonstration of a platform provider’s integration of generative AI into their system to create structured learning content. It worked. That conversation, along with investigations and experiments I’m running in preparation for an EEP project on the topic, strongly suggest to me that the tech is good enough today to change the economics of course design enough to completely disrupt the old publisher model.

I don’t think the next step is “robot tutor in the sky 2.0.” But fundamentally changing the economics of learning design is entirely plausible in the near term. AI will assist learning designers rather than replace them. It will make the job much easier, more affordable, and quite possibly more fulfilling for the people doing the work. It will be so cheap that it won’t even be a product. It’ll be a feature set.

I believe the era of AI-assisted OER and local design is coming. That could be exciting, right?

But it hasn’t happened yet.

At this moment, we’re waiting. Meanwhile, the publishers must see what’s coming. What are they doing to prepare? Generative AI is going to shift the value of digital learning products from the content to the platform and from crafted finished products to products that enable craft. Theoretically, it may not be too late for the publishers to respond. In practice, I’ve heard from friends in the industry that their employers have been disinvesting in their platforms over the past few years. I don’t know what they’re thinking right now.

So we’ll wait and see.

LMSs

We could call the textbook publishers’ root problem one of product/market fit. Their product no longer meets the needs of the market and they haven’t been well-equipped to either change their product or focus on a different market.

Many have argued for a long time that this is true with the LMS. That the product category is going to die. The people making that argument have been wrong. Repeatedly. Forever. For so long, in fact, that the loudest voices in this camp have largely left EdTech.

But are they finally right? I don’t know.

Before I get into the details, here’s a depressing question: How many broadly used EdTech product categories can you think of that were created since the invention of the LMS?

Yes, shift happens. But less often than one might hope.

Back in 2014, I wrote an unintentionally infamous rant called Dammit, the LMS in which I took on all the critics who were arguing the LMS was dead or dying. I’ll quote at length because it gets to the heart of the product/market fit conundrum:

Let’s imagine a world in which universities, not vendors, designed and built our online learning environments. Where students and teachers put their heads together to design the perfect system. What wonders would they come up with? What would they build?

Why, they would build an LMS. They did build an LMS. Blackboard started as a system designed by a professor and a TA at Cornell University. Desire2Learn (a.k.a. Brightspace) was designed by a student at the University of Waterloo. Moodle was the project of a graduate student at Curtin University in Australia. Sakai was built by a consortium of universities. WebCT was started at the University of British Columbia. ANGEL at Indiana University.

OK, those are all ancient history. Suppose that now, after the consumer web revolution, you were to get a couple of super-bright young graduate students who hate their school’s LMS to go on a road trip, talk to a whole bunch of teachers and students at different schools, and design a modern learning platform from the ground up using Agile and Lean methodologies. What would they build?

They would build Instructure Canvas. They did build Instructure Canvas. Presumably because that’s what the people they spoke to asked them to build.

In fairness, Canvas isn’t only a traditional LMS with a better user experience. It has a few twists. For example, from the very beginning, you could make your course 100% open in Canvas. If you want to teach out on the internet, undisguised and naked, making your Canvas course site just one class resource of many on the open web, you can. And we all know what happened because of that. Faculty everywhere began opening up their classes. It was sunlight and fresh air for everyone! No more walled gardens for us, no sirree Bob.

That is how it went, isn’t it?

Isn’t it?

I asked Brian Whitmer the percentage of courses on Canvas that faculty have made completely open. He didn’t have an exact number handy but said that it’s “really low.” Apparently, lots of faculty still like their gardens walled. Today, in 2014.

Canvas was a runaway hit from the start, but not because of its openness. Do you know what did it? Do you know what single set of capabilities, more than any other, catapulted it to the top of the charts, enabling it to surpass D2L in market share in just a few years? Do you know what the feature set was that had faculty from Albany to Anaheim falling to their knees, tears of joy streaming down their faces, and proclaiming with cracking, emotion-laden voices, “Finally, an LMS company that understands me!”?

It was Speed Grader. Ask anyone who has been involved in an LMS selection process, particularly during those first few years of Canvas sales.

Here’s the hard truth: While [one LMS critic] wants to think of the LMS as “training wheels” for the internet (like AOL was), there is overwhelming evidence that lots of faculty want those training wheels. They ask for them. And when given a chance to take the training wheels off, they usually don’t.[…]

Do you want to know why the LMS has barely evolved at all over the last twenty years and will probably barely evolve at all over the next twenty years? It’s not because the terrible, horrible, no-good LMS vendors are trying to suck the blood out of the poor universities. It’s not because the terrible, horrible, no-good university administrators are trying to build a panopticon in which they can oppress the faculty. The reason that we get more of the same year after year is that, year after year, when faculty are given an opportunity to ask for what they want, they ask for more of the same. It’s because every LMS review process I have ever seen goes something like this:

- Professor John proclaims that he spent the last five years figuring out how to get his Blackboard course the way he likes it and, dammit, he is not moving to another LMS unless it works exactly the same as Blackboard.

- Professor Jane says that she hates Blackboard, would never use it, runs her own Moodle installation for her classes off her computer at home, and will not move to another LMS unless it works exactly the same as Moodle.

- Professor Pat doesn’t have strong opinions about any one LMS over the others except that there are three features in Canvas that must be in whatever platform they choose.

- The selection committee declares that whatever LMS the university chooses next must work exactly like Blackboard and exactly like Moodle while having all the features of Canvas. Oh, and it must be “innovative” and “next-generation” too, because we’re sick of LMSs that all look and work the same.

Nobody comes to the table with an affirmative vision of what an online learning environment should look like or how it should work. Instead, they come with this year’s checklists, which are derived from last year’s checklists. Rather than coming with ideas of what they could have, the come with their fears of what they might lose. When LMS vendors or open source projects invent some innovative new feature, that feature gets added to next year’s checklist if it avoids disrupting the rest of the way the system works and mostly gets ignored or rejected to the degree that it enables (or, heaven forbid, requires) substantial change in current classroom practices.

This is why we can’t have nice things.[…]

There. I did it. I wrote the damned “future of the LMS” post. And I did it mostly by copying and pasting from posts I wrote 10 years ago. I am now going to go pour myself a drink. Somebody please wake me again in another decade.

Dammit, the LMS

Well, here we are. A decade later. Has anything changed? I’m told that something called a “Next Generation Digital Learning Environment (NGDLE)” popped up during my slumber. But it was gone by the time I woke up. Other than that, my friends in the trenches tell me that largely, no, not much has changed. The rapid shifts in market share of various LMSs have slowed now that Blackboard has staunched the bleeding. (Former Instructure CEO Josh Coates once told me, “We know we can’t keep feeding off Blackboard’s carcass forever.”) Moodle is still out there, Moodling along. Every once and a while, I get a question from somebody about whether they should choose D2L Brightspace or Instructure Canvas. Invariably, their question ends with some version of, “It probably doesn’t matter much, right? I mean, they’re pretty much the same.” My answer has been, “That’s mostly true, except when it’s not. The differences might or might not matter to you depending on the specifics of how you’re using the system.” Nothing in the ecosystem has forced shift. Customers complained but didn’t demand anything different. Quite the opposite.

That said, I’m sensing that more may be shifting than is apparent on the surface. How much will change and how much those changes will matter both remain to be seen.

Instructure and Blackboard are both owned by Private Equity companies now. While that sentence often cues ominous music, I’m not sure it’s the case here. Blackboard is part of Anthology, which does…well…honestly, I’m not entirely clear. (I guess it’s time for Rip Van Winkle to have a look around again.) At first glance, it looks to me like they have a student administration and success platform along with a bunch of services. So…that’s different. They also have the Ally accessibility management tool, which is one of the very few products I’ve seen customers get genuinely excited about in EdTech. When I add those pieces up, I…well…I can’t add them up yet. There’s too much I don’t understand. At some point, I’ll reach out to my friends at the company and get a clearer picture from them.

Instructure bought Badgr and seems to be leaning into CBE. They also bought…a digital adoption platform? I worked extensively with that tech in corporate L&D 20 years ago, long before SaaS and product-led growth. Back then, we mostly used it to boost worker productivity when using complex and confusing software applications. I always wondered why the product category didn’t catch on in education and training. Anyway, Instructure has made a couple of interesting and surprising tuck-in acquisitions. Is there a larger strategy here? Again, I should ask my friends over there.

D2L has been making some early moves into content production (building on an infrastructure that’s always been relatively better than its competitors for learning design) and has been quietly rebuilding its architecture into microservices in a Ship of Theseus sort of way. In their case, I actually have been talking to them a bit about what they’re up to. I’m not clear on the degree to which they’ve converged on a holistic strategy but they definitely have some interesting moves in mind. I’ll have to find out from them what I can share and probe a little more about how it all adds up.

In total, it feels like these companies are getting ready to finally differentiate from each other, not because existing customers are demanding change but because the market is saturated. Everybody in higher ed has an LMS. International growth is…fine, but not transformative. K12 and corporate markets are tougher than they appeared to be. LMS companies are not going to get enough growth by just selling the same product to more customers. They need to either sell different stuff to their existing customers or rethink their core product so that it’s useful in big new ways that attract different customers. They have to find new needs to satisfy. Each of the major higher education LMS companies appears to be approaching the challenge in a different way.

That would (finally) be interesting, wouldn’t it? But again, not much visible has happened yet. The Blackboard thing seems pretty dramatic. But I haven’t yet heard from anyone who thinks it will change the market meaningfully. Blackboard doesn’t even come up in any LMS selection conversations that I’ve had.

One area we might see an opportunity to change the value proposition could come from…wait for it…generative AI. If learning design and content generation costs are dropping through the floor, then the value shifts to platforms that can generate those experiences, fine-tune them, run them for students, and return data back. Is the LMS the right platform for that? It hasn’t been a great fit so far, but…maybe?

OPMs

I don’t know what to say about OPMs because I don’t know what they are anymore. If Coursera, Noodle Partners, iDesign, Guild Education, and Project Kittyhawk can all be considered OPMs, then it’s hard to have a coherent conversation about the “product category.”

Very roughly, the market seems to have bifurcated. The biggest players are sticking to their roots, which is helping universities find more enrollments. Yes, yes, they provide many other services, stand for mom and apple pie, yada yada yada. But at their heart, they help universities expand their ability to spin up, market, and sell more online programs. This is rapidly evolving into a technology platform game, which may be one reason why the Department of Education’s “dear colleague” letter took such a broad swipe at EdTech and not just traditional OPM services. As I wrote in “Coursera is Evolving into a Third-Wave EdTech Company,”

Coursera has always thought of itself as a two-sided market. For those unfamiliar with the term, a two-sided market is one where the company’s primary business is to connect buyers with sellers. Amazon, Etsy, Airbnb, and Uber are all examples of this sort of business. Yes, they were attached in the early days to selling a particular form of MOOC as an individual product, much as Amazon only sold books in the early days. Much of the attention during the early years of MOOCs was on the pedagogical model of the MOOC itself, which is not very effective, and on the MOOC course delivery platforms, which directly translated lecture-model courses into an infinite lecture hall, with some relatively modest technological improvements. The innovation that got the least attention at the time was Coursera’s nature as a two-sided market. I remember talking to Daphne Koller about this circa 2014 (in front of one of those ridiculous fountains in the Swan and Dolphin Hotel at a Sloan-C conference).

I’m not sure that EdX ever fully grasped the implications of the two-sided market model. 2U might; it’s hard to tell right now. The company’s in-process rebranding is confusing and their clearest marketing point so far has been that MOOCs lower the advertising costs for degree programs. Coursera, on the other hand, understood the business model implications early on, one of which is that two-sided markets tend to produce one big winner in any given space. Who is the second-largest competitor to Amazon? Walmart? Wayfair? The distributed network of stores that Shopify powers? I don’t know. The answer isn’t obvious. It’s not like Coke and Pepsi….

The Coursera platform, writ large, connects universities, learners, government agencies, megacorporations, and local employers. It helps open up new opportunities for universities to reach students without falling afoul of the “dialing for dollars” problem that plagued for-profit universities and create ethical and legal complexities for OPMs.

A multi-sided market also offers some benefits to the educational mission relative to other models. If, for example, you’re an OPM that has heavily subsidized the creation of a degree program in exchange for a share of the revenues for ten years, then you need to make sure your up-front investment pays off. This is true of any business that invests up-front in building products, including textbook publishers. In a multi-sided market, depending on how the compensation is set up, the marketplace owner shouldn’t care much about whether the company sells 100,000 units of one product or 1,000 units each of 100 products. For education, some programs are essential for students, local economies, and important business niches, even if they don’t require a lot of trained individuals. So a well-functioning multi-sided market should, all else being equal, offer more educational opportunities within a scalable model.

Coursera is Evolving Into a Third-Wave EdTech Company

Amazon, at its heart, is a way for product vendors to sell more stuff to more people with less effort. MOOC platforms, as they exist today, seem to be a way for certificate and degree vendors to sell more stuff to more people with less effort. Sure, the MOOC companies have course authoring and delivery platforms underneath. But nobody would care about those platforms if they weren’t attached to a marketplace. I know a handful of American universities that adopted OpenEdX as a stand-alone learning platform. Most have dropped it. I haven’t heard anybody begging for Coursera to make its platform available separate from the marketplace either.

This is why Guild is now getting lumped as an OPM with increasing frequency. If you think the point of an OPM is to fill more seats in online programs, well, that’s what Guild does. So yeah, it’s hard to define what an OPM is or how it works, which may be why the Department of Education seems confused on the topic.

Is this part of the space evolving? I don’t know. Everybody is so cash-constrained right now. I haven’t noticed the big players making any big moves. Also, their strategies feel incomplete to me. I see a lot more movement inside some universities toward competencies. The platforms do help break down the degree into smaller marketable units and sell enough of them to give them credibility. A “MicroMasters” is a thing now. Sort of. But overall, the connective tissue with employers, both on skills definition and on proof of competency driving employment, is still pretty sketchy except in a few niches.

Meanwhile, fee-for-service shops like iDesign seem focused on helping universities build capacity of various forms—mostly in program and course design. That’s great. It’s needed. But it will never be a giant business. And I’m not sure if generative AI helps or hurts them. They may find themselves having to react to moves made by better-funded learning platform companies. Or not. There’s nothing about generative AI that would require the resources of a big LMS or courseware delivery platform company to deliver value.

The OPM gold rush has run its course. Now we have chaos. Something, or some things, are going to emerge out of it. But I don’t know what they will be or what value they will provide. Or when. Or from which providers.

What else is there?

As usual, I won’t write about ERP and CRM. Not because they’re unimportant. They’re very important. But they’re also an entirely different sort of mess. For reasons that I won’t go into, these product categories are incredibly difficult to make work smoothly and intuitively in education, where complex workflows vary so widely. Until I see signs that this fundamental dynamic is shifting, I won’t devote significant attention to following these big enterprise systems.

I could run down a list of product categories that either completely imploded or are struggling along. Learning analytics. Courseware platforms. ePortfolios (a.k.a. Comprehensive Learner Records?). Some of these may become more interesting than they have been. I’ll save them for future posts.

What else?

AI, AI, AI. Nobody has any money to invest or spend on anything except on AI. So far, most of the product ideas I’ve seen are either trivial or pie-in-the-sky. My AI noise filter is set pretty high at the moment. But I’m going to start lowering it a bit. There are some folks who have been thinking and working hard on real products since before the ChatGPT hype hit (some of whom have been very persistently and creatively trying to get my attention). I will start taking a few of these calls. A few. At this point, I’m looking for thoughtful approaches, realistic thinking about the tech, and identification of real and solvable problems. I don’t expect the products to be right yet. I’m more interested in the people.

On the bigger picture, I read countless articles about AI and the future of work. While that kind of thinking is fine and probably necessary to a point, I personally don’t like to write about possible changes that are further out than I can see clearly. I can see AI having a direct impact in several areas, which I will write about as opportunities come into focus. There will be impacts on education and EdTech in the near future, some of which I may see coming and some of which I definitely won’t. None of it is quite here yet. Generally speaking, we tend to overestimate how quickly these technologies will penetrate particular markets because we forget about all the human stuff that gets in the way. And there is a lot of human stuff in education.

That said, one of the more remarkable affordances of generative AI is its ability to make natural language function as both a user interface and a programming language. It reduces friction like nothing I’ve ever seen before. So maybe we’ll see meaningful innovation faster this time.

Or not. Right now, we’re waiting.

I hate waiting.