As with much of the venture capital world, EdTech venture funding has slowed to a trickle overall and is almost completely frozen in some areas, such as early-stage investments. Conventional wisdom seems to be that this state of affairs won’t last forever. Since the proximate causes of the situation are falling stock prices and high inflation, the investing environment should improve significantly during 2023 as inflation falls and the stock market begins to recover.

Unfortunately, this may be an oversimplification. Longer-term changes in the markets may cause lasting damage to the kinds of private equity (PE) companies that typically buy EdTech start-ups. And since venture-funded EdTech companies are much more likely to be sold to PE companies than they are to become publicly traded, the harm to EdTech venture funding caused by these long-term shifts could far outlast any slowdown in broader venture investing.

If I am right, this is bad news not only for investors and start-ups but for EdTech companies of all sizes and, ultimately, for their academic customers.

How venture funding works

In order to understand the problem, we have to start with the basics. For example, where do venture capitalists (VCs) get the money that they invest? The short answer is “from other investors.” Suppose I manage Harvard’s endowment fund. I already own half of the stock market and am looking for other opportunities. I’m interested in venture capital, particularly in education, but I don’t have the time or expertise to vet individual start-ups. I might become a limited parter (LP) in a VC fund, which is a little bit like investing in an actively managed mutual fund. The VC firm takes my money and spreads it around to start-ups that the partners believe are good bets.

The stock market and interest rates have strong impacts on my comfort level with high-risk investing. If my endowment fund is heavily invested in S&P 500 stocks and that investment has dropped by 20% over the past year (as the S&P 500 did in 2022), I may feel a little queasy about investing in more risky bets like startups. I’m more likely to preserve my capital.

Suddenly VCs face a much more difficult environment for raising investment funds. If they are trying to raise a new fund, they’re going to have to wait a while. If they have funds to invest, they may want to slow down and make their money last.

On top of their cash crunch, they also struggle to decide how much companies are worth. There’s an old investing adage that one should not try to catch a falling knife. Since nobody knows how much further the stock market will drop, and since risks in start-ups are both higher and harder to gauge than with publicly traded companies, many VCs are choosing to simply hold onto their cash and wait until the markets stabilize.

Again, conventional wisdom is that these VCs can’t sit on their money forever. Their LPs expect them to invest and make returns. So at some point, the cash that is sitting on the sidelines will come flooding into the market.

Unfortunately, that influx may be short-lived for EdTech.

EdTech’s PE problem

So far, we’ve looked at the VC markets and public stock markets. But there’s a third, less visible but huge slice of the capital markets that we haven’t examined yet: private equity (PE). And it turns out that PE is heavily involved with EdTech.

Technically, venture capital is a type of private equity. Interpreted broadly, PE simply means that investors are putting their money into companies that are not for sale on publicly traded stock markets. Companies that are labeled as PE companies, much like their VC counterparts, raise their investment capital from individual and institutional LPs.

But where VC funds can be thought of as growth investors, trading high risks for high returns, classic PE funds typically act more like value investors. They often look for companies they think are undervalued and could be turned around by cutting costs, changing management, and focusing the strategies of the companies they invest in.

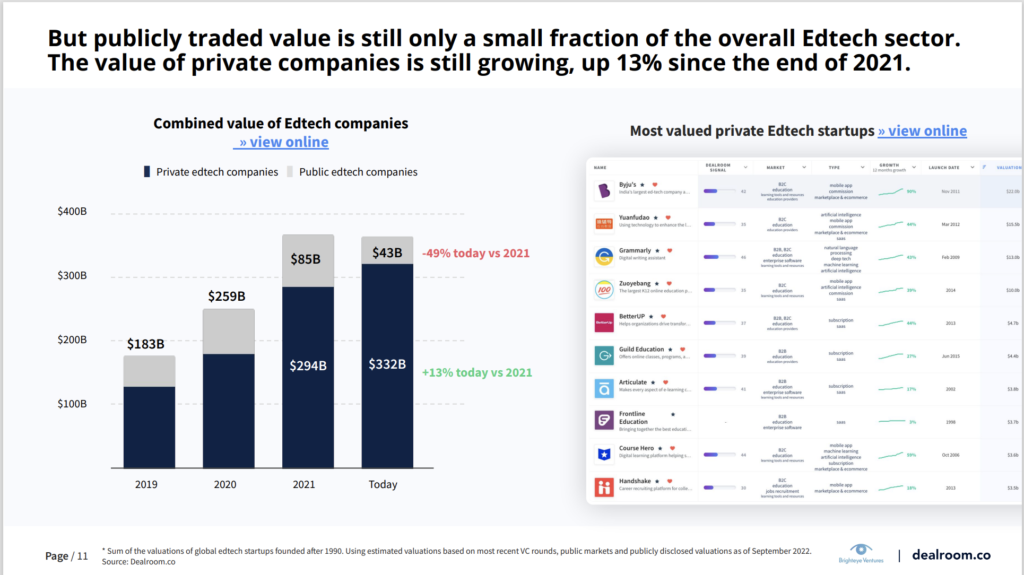

According to Dealroom, roughly 90% of EdTech is privately owned. This includes household names like Instructure, McGraw-Hill Education, Cengage Learning, Ellucian, and University of Phoenix, among many others.

In many investment sectors, venture-backed companies will often aspire to become publicly traded companies. In EdTech, the vast majority are likely to be acquired by larger PE-backed companies. VC investors understand this and plan for it when choosing the companies they invest in. At this moment, PE firms and the companies they invest in are going bargain-hunting. Distressed start-ups are selling cheaply. expect to see a substantial uptick in announcements about EdTech mergers and acquisitions over the next six months.

That party may not last long, however.

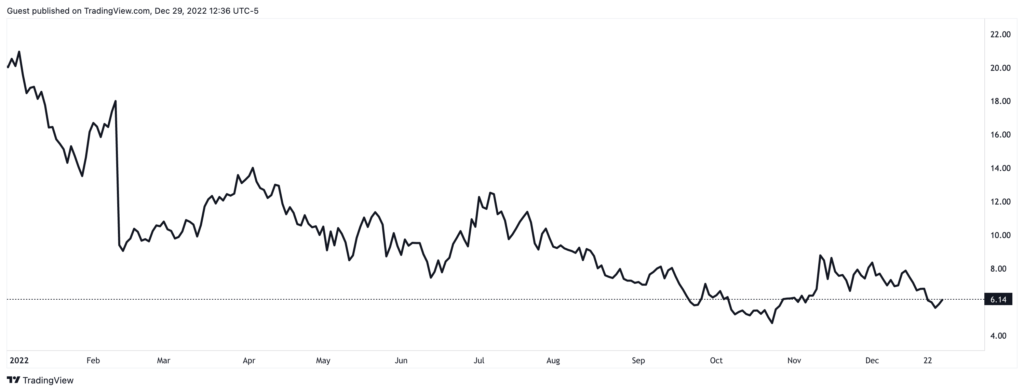

Given the current financial climate, this state of affairs creates a medium-term and a long(er)-term problem for EdTech. Medium-term, private equity companies tend to be much slower in writing down their valuations. The stock market is in the midst of a brutal process of writing down the value of publicly traded companies. For example, here’s the one-year stock chart for 2U (TWOU):

Could 2U’s stock price decline further? Sure. For example, if the stock market as a whole continues to drop, then 2U could easily drop further as well. The laws of gravity apply. That said, 2U’s stock price reflects real-time conditions, including minute-by-minute decisions by investors. It’s up-to-date.

In contrast, PE-owned companies report their earnings quarterly and make their own calculations regarding the underlying value of their companies. They are financially motivated to drag their feet on reducing the estimated value of their investments. They are audited once a year. So there is much more lag in the revaluation of PE-owned companies in a bear market like this one. The PE-heavy EdTech sector is likely to get hit by another round of significant company valuation downgrades just around the time that the publicly traded markets are recovering.

As the saying goes, sh*t rolls downhill. If PE-owned EdTech companies do not have the cash to make acquisitions, then VCs will have to rethink how hard it will be to sell the companies they invest in. They will adjust their investment strategies accordingly. The generic advice for venture-backed companies these days is to have enough cash on-hand to last two years until your next investment. I wonder if that time period needs to be longer in EdTech.

The longer-term PE problem

Unfortunately, the troubles don’t end there.

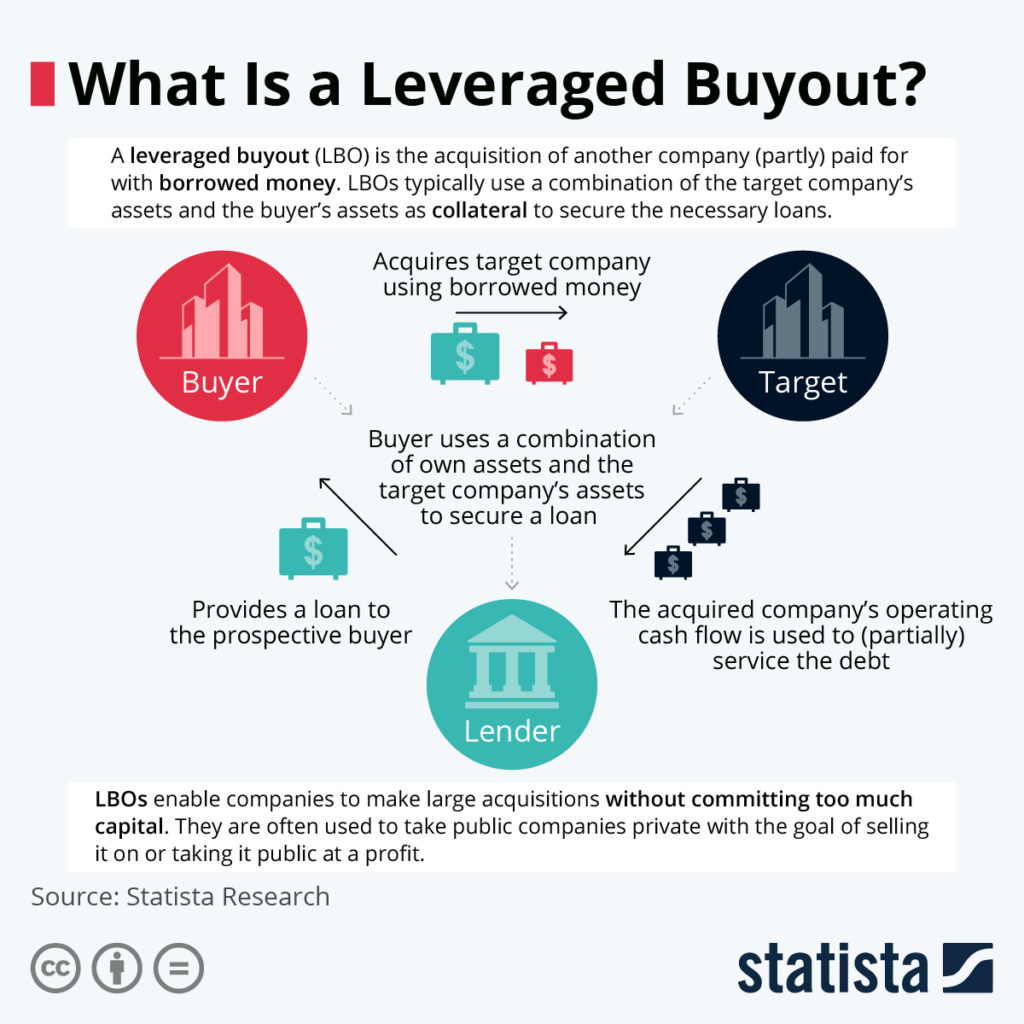

Many EdTech investments by PE firms are made through what’s known as “leveraged buyouts.” Simply put, a leveraged buyout is when the investor borrows a lot of the money it uses to invest in or purchase the company. It’s a bit like a mortgage. You pay 20% of the price of the house in cash and finance 80% with the bank.

Of course, if you happen to have a variable-rate mortgage, need to refinance, or are looking to get a mortgage on a new house, you may suddenly find that your costs are much higher than you expected them to be.

This happens with companies in leveraged buyouts too. When the loans—or “debt covenants”—used to buy these companies come to term, they usually have to be refinanced. Except that this time the interest rates are much higher. Suddenly, money that was earmarked for building new features or paying employees has to go toward paying interest on the loans.

That’s only half the problem. Remember, PE firms have limited partners just like VCs do. PE companies employing leveraged buyouts are making a bet that the value of the companies they’re buying with debt will rise at a faster rate than their interest payments. As those payments go up, the investments become less attractive. PE firms are going to be more likely to make draconian budget cuts in their portfolio companies, try to unload the most heavily indebted ones in whatever way they can (including them off in pieces), and make fewer, more careful investments.

One way to think about the choice LPs are faced with is the relationship to an alternative investment in Treasury bonds, which are so safe when held to term that they are referred to as “riskless investments.” Here’s a chart of the historic interest rates on the 10-year U. S. Treasury note:

Interest rates have been historically low since about 2010. While interest rates will come down from their current levels, they are more likely to settle around their historical average of roughly four percent. This change has been sudden, impossible to time, and diverges from the norm that even 30-year-old PE employees have been in the business. PE companies will have to generate significantly better returns than the “riskless” alternatives even as they face the headwinds of higher interest rate payments. That means leveraged companies will need to increase their financial performance in order to provide the same benefits relative to their alternatives.

I’m not sure the PE firms are ready for this.

To be clear, the situation is not apocalyptic. PE investors were purchasing companies with debt when the interest rates were closer to the historical norm and will undoubtedly continue to do so in the future. The problem is more that many of their current investments may have been made based on assumptions about the interest rate environment that no longer hold. While the system will need a while—possibly a few years—to rebalance itself, it eventually will.

Still, a debt hangover in PE would not be good news for anyone who cares about EdTech. Big companies that customers depend on will be squeezed, spending less, and laying off employees. VCs, knowing that their exit options have become more limited, will make fewer investments that are less risky and are more likely to be near-term profitable. We are likely to see even less investment in companies that can have significant and scaled impact on student outcomes because these companies often need to invest for a longer period of time before they make more money than they spend. Educators and educational institutions relying on companies of all sizes will be at increased risk.

The handful of publicly traded EdTech companies will largely be subject to different dynamics and should recover with the stock market and the economy. While a few of them may be debt-heavy, many more of the PE-funded companies will have this problem. And unfortunately, a heavy debt load could take years rather than months or quarters to work its way through the system.

We need to know more

To get a better grip on the shape and severity of the problem, somebody who is more of a financial analyst than I am should compile some data on the scope of the problem (if they haven’t done so already). Ideally, I’d like to see a list of “red light” companies that are highly leveraged and whose covenants will be coming due soon and are already under financial stress. In other words, the EdTech firms for whom higher interest rates will put them in jeopardy. Next, it would be good to see a list of “yellow light” companies whose upcoming debt refinancing is likely to put them under stress, meaning they are not in mortal danger from higher interest rates but would be put under enough pressure that they would probably need to make significant additional cuts. And finally, I’d like to see an overall read on the debt situation for the sector, with a special emphasis on PE-funded companies that have historically been acquisitive.

Ecologists have learned that the health of a given ecosystem is heavily determined by the health of the apex predators in that ecosystem. In much of EdTech, PE-owned companies are apex predators. They are at the top of the food chain. Clarity regarding the debt of PE-owned EdTech would give us one measure of the financial health of the EdTech ecosystem as a whole.