Strayer Education and Capella Education just announced a merger.

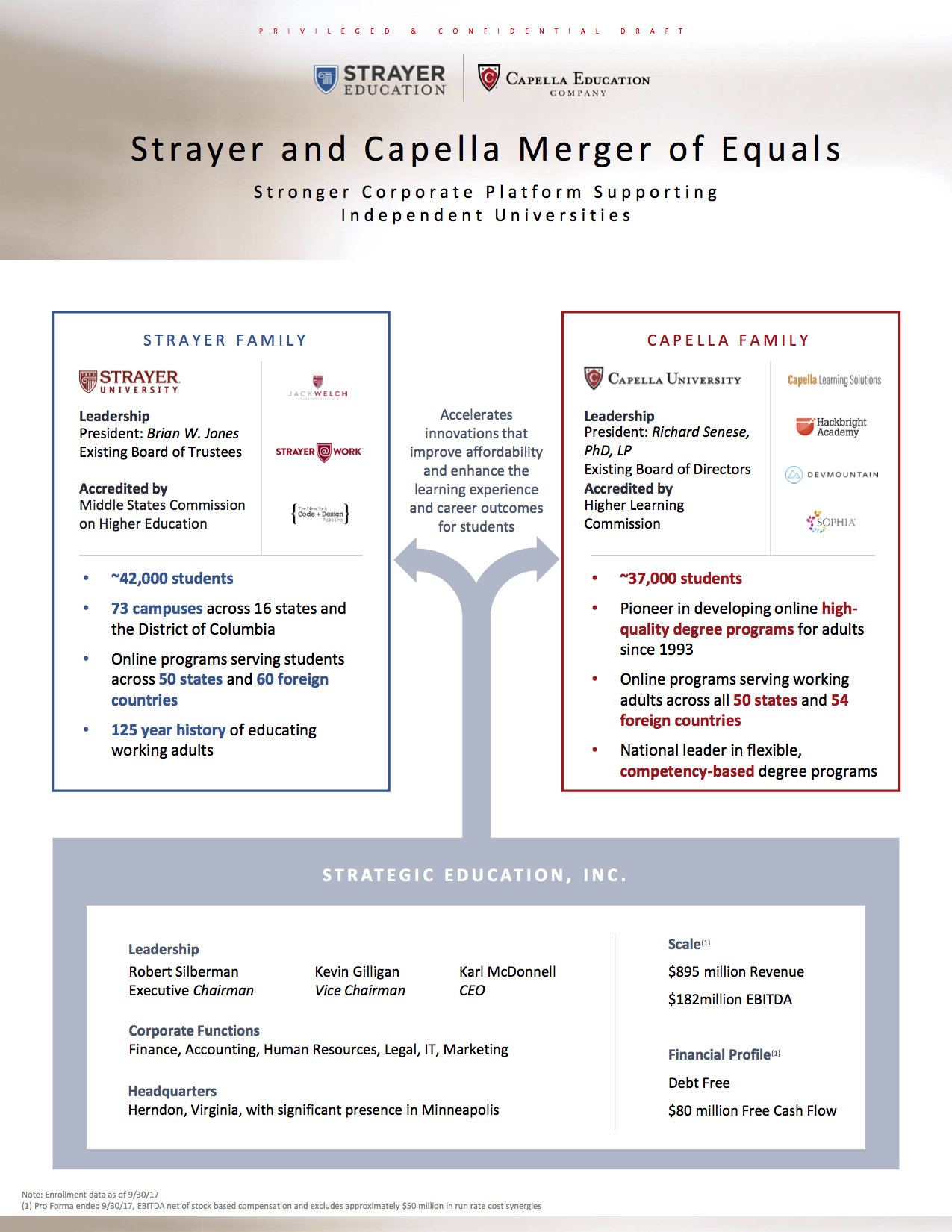

Strayer has the upper hand in the merger, taking a 52% controlling interest in the new company, which will be called “Strategic Education” and will maintain Strayer’s “STRA” stock symbol. With combined enrollments of close to 80,000 students, the new company will be one of the largest for-profits in the US.

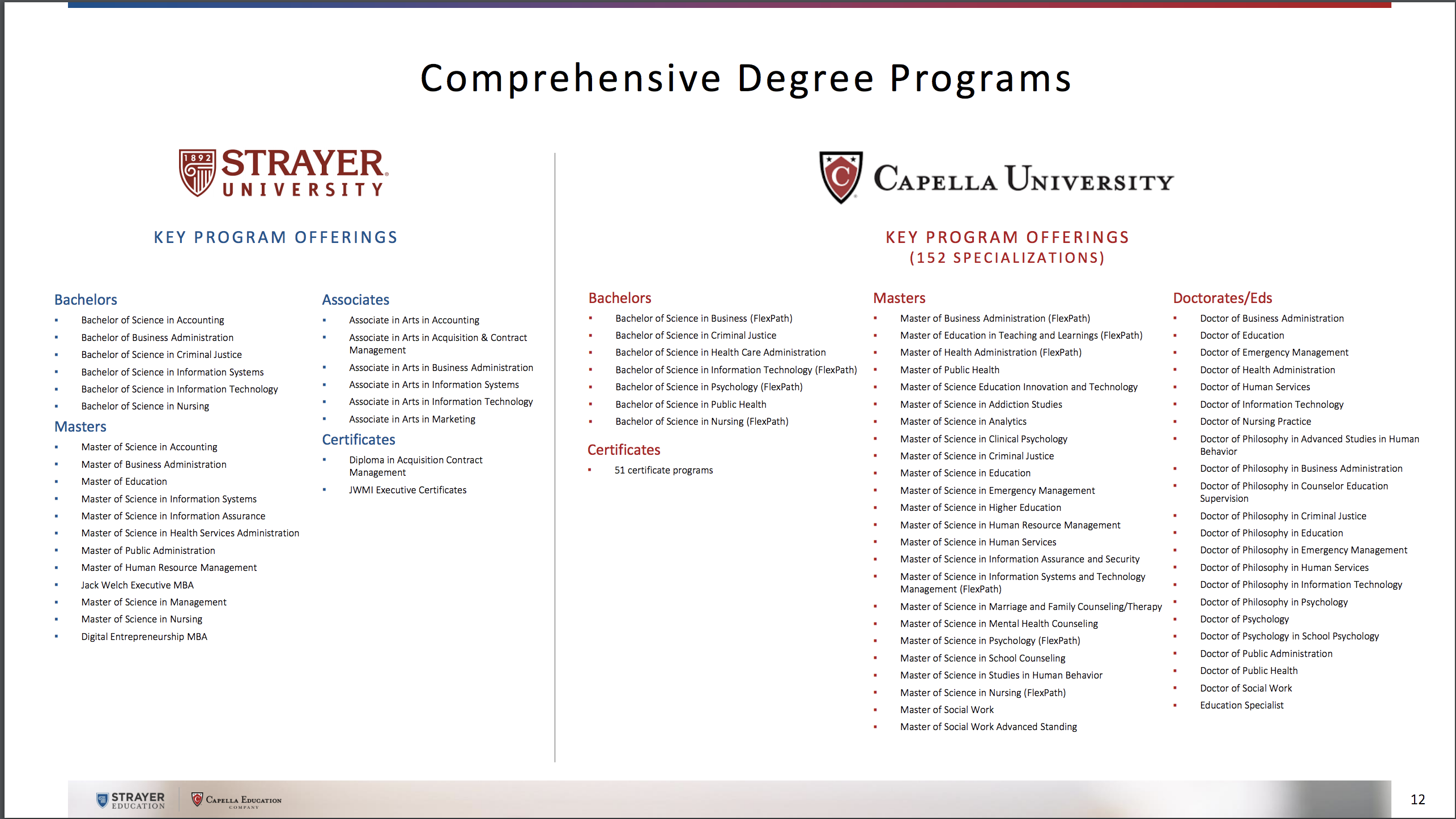

As the company touts, there is a high degree of complementarity between the two entities. First, both kept their noses clean during the for-profit scandal era and maintained good reputation. Capella has, in fact, shown a willingness to actively collaborate with the broader university community, including not-for-profits, by sharing best practices and collaborating in research on topics like learning analytics. Strayer’s degrees are largely concentrated in business and IT, while Capella has a broader portfolio including education, health care, and criminal justice. Strayer has a number of physical campuses for classroom or blended learning, while Capella is focused on fully online. Strayer is known to be particularly good at building partnerships with employers, while Capella is known for its work in new educational trends like learning analytics and Competency-based Education (CBE). Strayer has a lot of working adults completing their undergraduate degrees while Capella has a robust set of graduate programs. Both dabble in other formats like code academies, and Capella has 51 certificate programs.

Assuming the merger goes through, both schools will continue to operate largely separately as independent brands. Faculties are specifically called out as remaining separate, though credits will be tranferrable from one institution to the other. The areas singled out for “consolidation” (read: layoffs) are “executive and corporate functions, certain marketing capabilities and IT operations.” Corporate headquarters will be in Virginia, where Strayer’s headquarters currently are, but IT will be run out of Minnesota, where Capella is.

When we look at this merger in the context of both Purdue’s acquisition of Kaplan, DeVry’s internal restructuring, and University of Phoenix’s transition of ownership and leadership, some trends in the for-profit space begin to emerge.1

Still on the defensive

Despite the hype about the Trump administration being friendlier to for-profits than the Obama administration, the truth is that we continue to see defensive moves. University of Phoenix’s old PE owner decided to sell the business, and the leadership brought in by the new owner promptly closed 20 campuses. DeVry fired its CEO after closing 14 campuses and settling a slew of state and Federal lawsuits.2 Kaplan decided to get out of the for-profit university business altogether. (What is left over of that company after the sale to Purdue, and what it will become going forward, is still unclear.) And the most immediate effect of the Strayer/Capella merger will be cost cutting in redundant operations.

In other words, Education Secretary Betsy DeVos has not changed the laws of physics. These institutions were under pressure before and are still under pressure now. We should not be surprised to see more closures like Corinthian Colleges and ITT Tech, particularly of second- and third-tier for-profits. They may not be driven by active prosecutions, but the damage to the sector has already been done. Government intervention wasn’t the sole cause of the collapse of Corinthian; lack of cash on hand played a role.

The questions going forward are (a) is the for-profit crash bottoming out, and (b) if so, what does their next act look like? It’s too early to tell regarding the first question, but we are getting some interesting hints regarding what the leadership of some of the larger for-profits think possible answers to the second one is.

Course design, analytics, and employer connections

A few details of the Strayer/Capella announcement stand out. The first one comes out of the rhythm of a merger announcement like this one. There’s a format of “Company A brings strength X while company B brings complementary strength Y.” The announcement touts one of Strayer’s strength as “close relationships with employers” that complements Capella’s “competency-based learning infrastructure, assessment capabilities and track-record of improving student success.” To begin with, these are real strengths of the respective companies rather than made-up talking points. Strayer is good at employer partnerships and does fairly extensive profiling of their students’ career goals and paths. Capella, for its part, was giving talks about their learning analytics work way back in the early days, before there were even products on the market.

The bit about CBE, which comes up several times in the released materials, requires a bit of unpacking. Capella offers two flavors of what they label Competency-Based Education: “FlexPath,” which is a fully self-paced program in the style of Western Governors University or SNHU’s College for America, and “Guided Path,” which Capella labels as CBE despite the fact that it is instructor-facilitated, delivered within a term structure for a class cohort, and charged by the credit. What they really mean by CBE in this case is what Phil calls “CBE lite” or what is more commonly known in academic circles as “backwards design,” where the outcomes and assessments are designed first and then the content is structured to match (rather than picking the content for the syllabus and then designing assessments after).

Only a relatively small percentage of Capella’s degree programs are full CBE FlexPath programs:

So most of these programs are not actually self-paced CBE but backwards-designed and traditionally delivered courses. That may actually be a lot more important. As Phil has written, full self-paced CBE is still struggling to take off. Backwards design, in contrast is a good practice for course designs that drive improvements in student outcomes and is also a prerequisite for various types of learning analytics and adaptive learning approaches as well as full self-paced CBE. So when Strayer touts Capella’s strength in CBE, the real value may be in the course design process and the ways in which those designs can be instrumented in the learning analytics.

Strong connections to employers, consistent application of backwards course design principles, and analytics supported by those course designs, are three areas where the centralized structure of for-profits enables them to move more quickly than many not-for-profits. Reading between the lines, it looks like the Strayer/Capella leadership think they have found a way to compete on quality. And they may not be the only ones tacking this approach. We see signs that at least pieces of these strategies are beginning to surface elsewhere. For example, it was interesting to see that the University of Phoenix’s new owner chose a new president who was previously an executive at McGraw-Hill Education, which currently styles itself a “learning science company.”

Kaplan is obviously different, but maybe not as different as it appears at first blush. They had a very strong learning science and analytics-driven approach to course design, driven by thought-leader Bror Saxburg (who recently left to work at the Chan-Zuckerberg Initiative). Purdue, for its part, pioneered retention early warning analytics. Despite some controversy regarding one of their research papers, the university has deep experience with using analytics to drive outcomes.

It’s still early days, but we may be seeing the beginning of a trend among for-profits to drive toward a particular notion of a quality education as a key competitive differentiator.

[…] These institutions were under pressure before and are still under pressure now,” he wrote in a blog post about the proposed merger. “We should not be surprised to see more closures like Corinthian […]