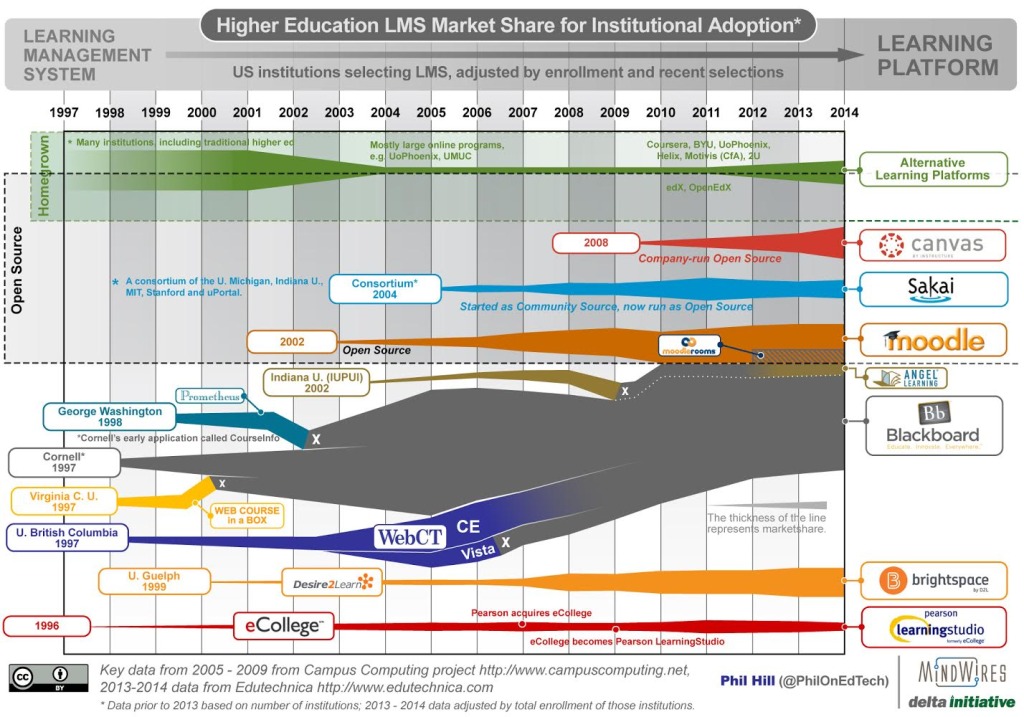

I shared the most recent graphic summarizing the LMS market in November 2013, and thanks to new data sources it’s time for an update. As with all previous versions, the 2005 – 2009 data points are based on the Campus Computing Project, and therefore is based on US adoption from non-profit institutions. This set of longitudinal data provides an anchor for the summary.

The primary data source for 2013 – 2014 is Edutechnica, which not only does a more direct measurement of a larger number of schools (viewing all schools in IPEDS database with more than 800 FTE enrollments), but it also allows scaling based on enrollment per institution. This means that the latter years now more accurately represent how many students use a particular LMS.

A few items to note:

- Despite the addition of the new data source and its inclusion of enrollment measures, the basic shape and story of the graphic have not changed. My confidence has gone up in the past few years, but the heuristics were not far off.

- The 2013 inclusion of Anglosphere (US, UK, Canada, Australia) numbers caused more confusion and questions than clarity, so this version goes back to being US only.

- The Desire2Learn branding has been changed to Brightspace by D2L.

- The eCollege branding has been changed to Pearson LearningStudio.

- There is a growing area of “Alternative Learning Platforms” that includes University of Phoenix, Coursera, edX and OpenEdX, 2U, Helix and Motivis (the newly commercialized learning platform from College for America).

- While the data is more solid than 2012 and prior years, keep in mind that you should treat the graphic as telling a story of the market rather than being a chart of exact data.

Some observations of the new data taken from the post on Edutechnica from September:

- Blackboard’s BbLearn and ANGEL continue to lose market share in US -[1] Using the 2013 to 2014 tables (> 2000 enrollments), BbLearn has dropped from 848 to 817 institutions and ANGEL has dropped from 162 to 123. Using the revised methodology, Blackboard market share for > 800 enrollments now stands at 33.5% of institutions and 43.5% of total enrollments.

- Moodle, D2L, and Sakai have no changes in US – Using the 2013 to 2014 tables (> 2000 enrollments), D2L has added only 2 schools, Moodle none, and Sakai 2 schools.

- Canvas is the fasted growing LMS and has overtaken D2L – Using the 2013 to 2014 tables (> 2000 enrollments), Canvas grew ~40% in one year (from 166 to 232 institutions). For the first time, Canvas appears to have have larger US market share than D2L (13.7% to 12.2% of total enrollments using table above).

Questions:

Where is the decision made on system adoption? dominant factor?

What changes have been made in these systems that warrant adoption or shift to alternative?

Is there a sense as to how these systems will evolve and are alternatives such as MOOC’s or Unizen’s promotion of a common platform in play here?

Tom – those are pretty broad questions, but we have addressed some of them in separate blog posts: https://eliterate.us/tag/lms/

At the risk of being too glib: the dominant factors the past few years in LMS decisions often center on forced migrations (end of life for system), need for better user experience / increased faculty adoption, and desire for better contract terms. So some of what warrants adoption is the status quo going away through end-of-life, or ‘contract’s ending, might as well see my options’. When decision is made to move, often UX drives.

I do not see MOOCs or Unizin as being key drivers for system evolution moving forward. I do see the strategy to deal with learning apps / moving past walled garden as important. Another factor which I’ll cover in future post is that for many specialized programs (CBE is one example), there is a lot of activity in developing a custom system, whether that is CBE-focused LMS from vendor or even school developing their own.